Bitcoin Dips Under $93K Mark as Leveraged Positions Worth $680M Get Wiped Out

Market Observers Flag Leverage-Fueled Rally Concerns

Major blockchain analytics platforms Glassnode and CryptoQuant are sounding alarms about the sustainability of Bitcoin’s recent climb toward $96,000, citing excessive leverage and insufficient organic buying interest as red flags that could signal continued price instability.

The world’s premier cryptocurrency shed approximately 3 percent of its value, settling around $92,500 after a derivatives-based surge lost steam. This downturn erased nearly $600 million worth of bullish bets and sent shockwaves through alternative cryptocurrency markets.

Massive Liquidation Event Strikes Overleveraged Traders

CoinGlass tracking systems revealed that cryptocurrency traders absorbed over $680 million in position liquidations during a 24-hour window, with long positions accounting for roughly $600 million of these forced closures—a clear indication that bullish speculation had reached unsustainable levels.

Altcoin Bloodbath Accompanies Bitcoin Retreat

The crypto market’s broader ecosystem suffered severe damage during Monday’s Asian trading hours:

- Solana (SOL) plummeted 6.7%

- SUI Network crashed 10%

- ZCash tumbled 10%

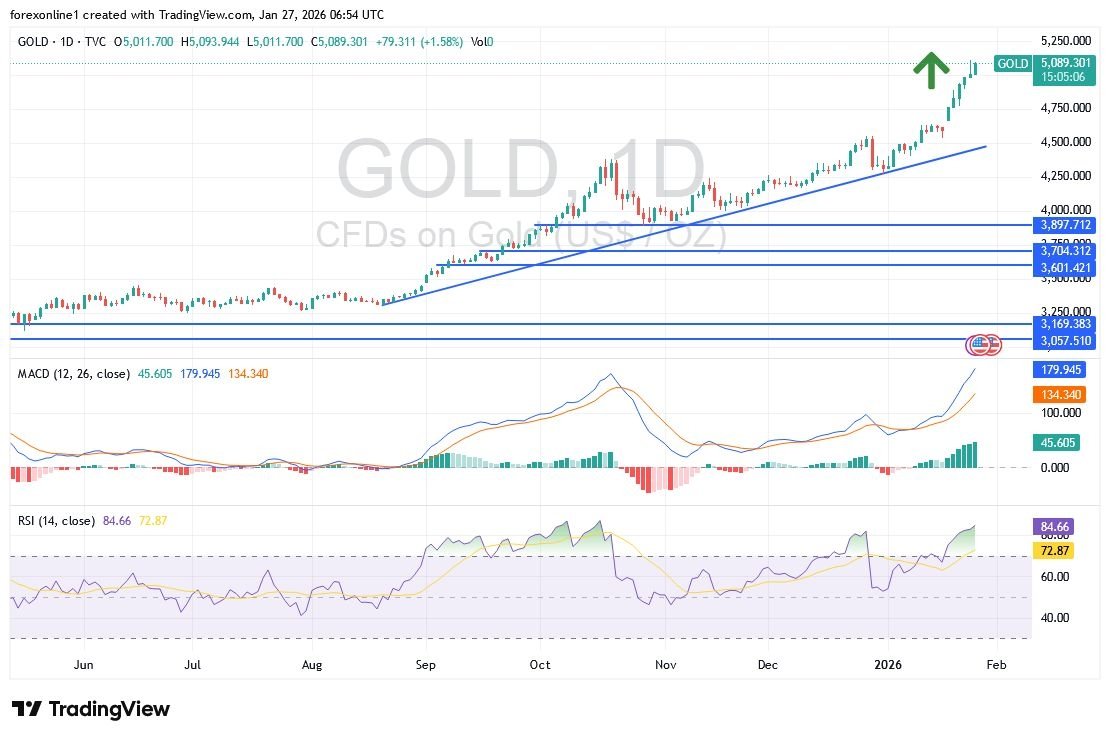

Meanwhile, traditional safe-haven asset gold surged 1.7% to reach $4,600, buoyed by geopolitical tensions surrounding new tariff announcements affecting Denmark and seven additional European nations.

Structural Weakness in Bitcoin’s Recent Advance

Derivatives Flows Drive Price Action, Not Institutional Accumulation

Glassnode’s comprehensive weekly analysis indicates that Bitcoin’s push toward the $96,000 threshold was primarily powered by mechanical derivatives activity—particularly forced short covering—rather than genuine accumulation by long-term investors through spot markets.

The blockchain intelligence provider emphasized that futures market depth remains inadequate, creating conditions where rapid price swings become inevitable once cascading liquidations subside. Additionally, Glassnode identified a dense resistance band created by long-term cryptocurrency holders who purchased near previous market peaks, forming a ceiling that has consistently rejected upward price movements.

Historical Indicators Suggest Caution

CryptoQuant adopted a more skeptical stance in their recent market commentary, suggesting the movement from late November might represent a temporary bounce within an ongoing bear cycle rather than the beginning of a sustained bull market.

The analytics firm highlighted Bitcoin’s position beneath its 365-day moving average hovering near $101,000—a technical threshold that has historically served as a critical dividing line between market regimes. Despite marginal improvements in demand metrics, CryptoQuant maintains that fundamental buying pressure hasn’t strengthened substantially, with genuine spot market interest continuing to contract and U.S.-based spot exchange-traded fund inflows remaining underwhelming.

Emerging Signs of Market Stabilization

Despite the concerning leverage dynamics, certain positive developments are materializing:

Glassnode documented a substantial slowdown in distribution activity from long-term Bitcoin holders compared to late 2025 levels. Additionally, trading flow patterns on major exchanges like Binance have shifted toward buyer dominance, while Coinbase-driven selling pressure has diminished noticeably.

Options Traders Remain Defensive

Derivative markets continue broadcasting mixed signals about future price direction. Glassnode’s options market analysis shows that while implied volatility measurements remain subdued, traders are still paying premium prices for downside protection in longer-duration contracts—revealing persistent investor wariness about potential downside scenarios.

Market Outlook Hinges on Spot Demand Revival

Both analytical firms conclude that Bitcoin’s price trajectory will remain heavily influenced by leverage fluctuations and liquidity conditions until substantial spot market buying pressure reemerges. This dependency on speculative positioning keeps the market vulnerable to abrupt reversals, maintaining heightened uncertainty for investors navigating current conditions.